Dear Tokeners,

We hope that you have written your letter to Santa Klaus ... and that at least, you have asked for a gift-package of Ethereum, or Polkadot ... 😀😀. We know that many of you will already be thinking about Christmas Eve dinner, that if you have invested during the year, it will surely be abundant ...

We are already preparing, but before that, we still have many things to tell. For example ... today we bring you two spectacular analyzes by two great analysts, one from the point of view of what is happening on the blockchain, and the other technically analyzing the graphs. Draw your own conclusions.

But we also bring you a great project that has increased its value by no more and no less than 9,000% in the last year. Today we will deal in depth with Terra (LUNA).

And also ... elEconomista, who opens the first correspondent in the Metaverse (good for them!). Which means that we will have fresh and warm news (we hope almost in real time). We are wondering when the gossip magazines will follow (because surely due to lack of characters, it won’t be ... 😋😲).

Well, enough, let’s get serious... “They may take our lives, but they will never take away…

Hodl it, enjoy it, share it and … sure 👇👇👇👇

On-chain Analysis of BTC & ETHER

Who should be the king?

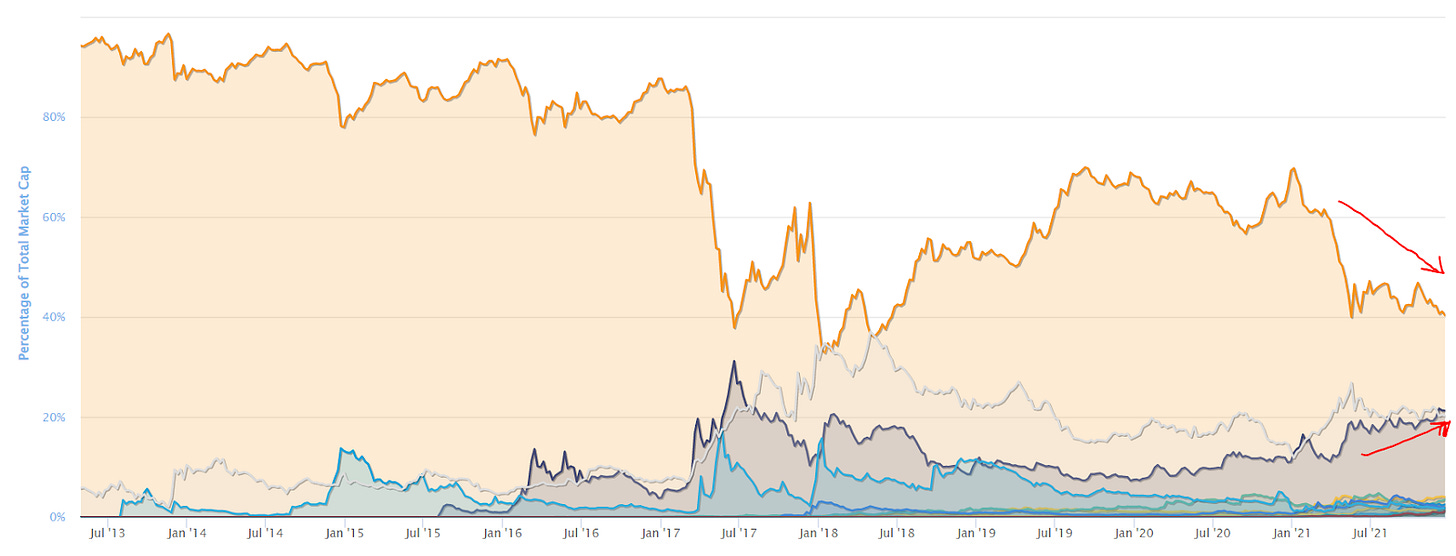

Before starting the analysis, I want to share a thought (which may have its detractors). The reason we continue to analyze Bitcoin's On-Chain metrics is because we need to understand the behavior of the industry's benchmark cryptocurrency, which currently holds 41% of the global market capitalization versus a 20% capitalization of Ethereum, leaving 39% for all the others, as you can see in the graph below.

This very high percentage of a single cryptocurrency in the global cryptocurrency market share exposes all underlying protocols, businesses and startups (especially reputational and market risk) to fundamental risks whose tokens and their price are too impacted by movements in the capitalization of Bitcoin, which makes it very very difficult to consider investing in Value in this ecosystem (with the premise that Bitcoin is still a highly speculative asset).

Even so, for us, who propose our strategies in the long term and in tokens that we consider to meet the value attributes, it requires us to understand what is happening within the Bitcoin Blockchain in relation to its "Stakeholders" (speculators, exchanges, miners, developers, holders, etc). The survival of Bitcoin as an asset depends a lot on the incentives to maintain Bitcoin as a Reserve of Value and that at the same time, a decrease in its capitalization does not destroy value to the rest of the alternative protocols and blockchains of the industry, taking everyone ahead the other Stakeholders that are not invested in the Bitcoin network.

Within the above reasoning, we are firm believers that the cryptocurrency that will end up taking the throne from Bitcoin in capitalization is Ether, native to the Ethereum network. This event is called by the ecosystem as “Flippening” and is based mainly on the substantial difference in the attributes of both cryptos (Bitcoin is “Sound Money” while Ether is “Ultra-Sound Money). More info about these concepts in the following link: https://bit.ly/3sm2eys

Our vision is oriented to the generation of value for all those who want to bet on this industry and the protocols that provide employment and wealth to people globally. This means that Bitcoin cannot continue to be the benchmark in value in the industry, because then the speculative component would continue to dominate and this is precisely the closest thing to the casino.

On the contrary, if Ether became the reference, the proposals already implemented by the network have managed to turn Ether into a true Reserve of Value, which would protect the rest of the ecosystem from pure speculation and would give each protocol the opportunity to demonstrate if your Token is invertible or not, considerably reducing the market risk.

We only have to see the enormous differences in billing between the two Blockchains, where Ethereum generates daily in network commissions (not counting the subsidy for the discovery of new blocks) an average of $ 30 million against the $ 500 million that validators earn on the network of Bitcoin on a daily average.

If we go to the number of daily transactions and see what each transaction generates on the network, in the case of Ethereum, an average of 1.1M daily transactions are taking place, offering a value of $ 27 per transaction to validators, while in the case of Ethereum Bitcoin network is offering a value of $ 2.5 per transaction to validators.

Logically, if we are based on Game Theory, the Ethereum network offers greater incentives for Stakeholders than the Bitcoin network offers. This represents a risk of capital transfer to the Ethereum network that could deteriorate confidence in Bitcoin and the industry in general.

Read more at 👉👉

Crypto Technical Analysis BTC, SOL and LUNA

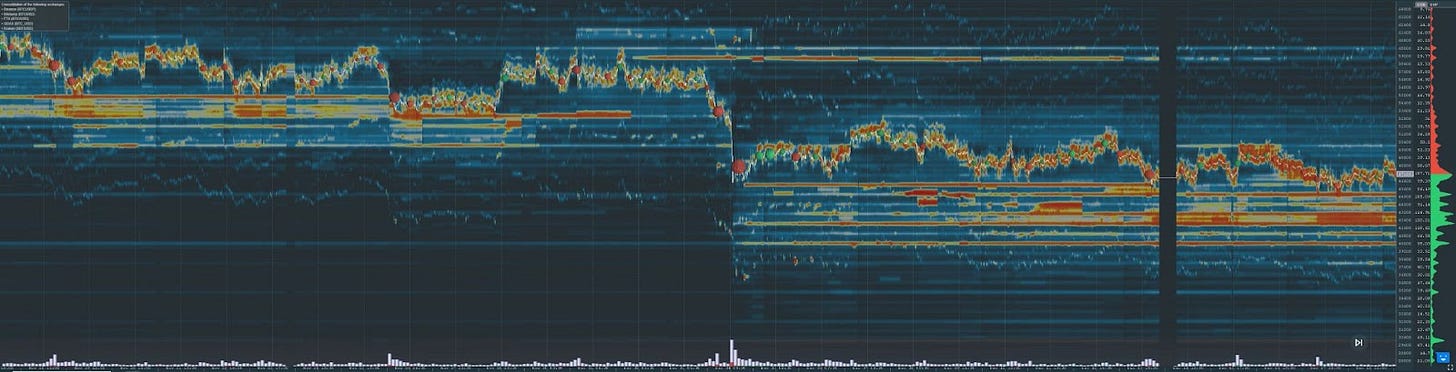

In this weekly article we will try to offer a clear vision of the key levels of the analyzed cryptocurrencies, according to a criterion of technical analysis and volumetric analysis, to offer concrete help to all those who work in the world of cryptocurrencies. This week we will analyze BTC, SOL and LUNA.

There are no relevant changes compared to last week. The 50,000 area is still a resistance and only the break of 54,400 would give a big bullish signal with area targets 60,000-63,000 and then 71,000. There is a lot of liquidity in the 44,800 and especially in the area of 43,200-41,600. This last zone, if lost, can quickly hit 40,000 and then 36,000 in a single session, potentially changing the trend.

Typically, the longer the price stays in the volumetric zone, the more likely there is to see a powerful trend. However, we advise not to expose yourself too much to the upside, because if those large areas of liquidity are touched and the price does not reverse immediately, the crash may be much deeper than the one in early December. For now we await volumetrically confirmed signals.

Possible operating strategy: short below 44,000 with a target of 41,600; If it breaks out strongly, increase the target short positions 40,000 and 36,000. In the event that prices retrace in a V shape or very rapidly, close shorts and open longs immediately. Long above 50,400 with a target of 54,400. Increase long positions above that level and after 60k. If the 50,000 area were to be rejected, go hunting for shorts.

Continue reading at ✔

Terra & Stablecoins

Dear Tokeners,

Welcome everyone once again to know all the characteristics that surround a great project that has increased its value by no more and no less than 9,000% in the last year. Today we will deal in depth with Terra (LUNA).

We will start by knowing what Terra intends to contribute to the ecosystem, the team that founded the project and what makes Terra unique in this wonderful and great cryptoverse.

Terra is defined as a blockchain protocol that uses stablecoins pegged to fiat currencies in order to power stable price global payment systems. According to their whitepaper, Terra combines price stability and wide adoption of fiat currencies with the censorship resistance of Bitcoin (BTC) and offers fast and affordable deals.

Development of Terra started in January 2018, and its mainnet was officially launched in April 2019. As of September 2020, it offers stablecoins pegged to the US dollar, South Korean won, Mongolian tugrik, and basket. Foreign Exchange Special Rights of the International Monetary Fund, and intends to deploy additional options.

Terra's native token LUNA is used to stabilize the price of the protocol's stablecoins. LUNA holders can also submit and vote on governance proposals.

Read more: 👉

Stablecoin supply grew by 388% this year, driven by DeFi and derivatives

The market for stablecoins experienced breakneck growth in 2021, with the supply for dollar-backed cryptocurrencies surging by 388%, according to data compiled by The Block Research.

As indicated by The Block Research's 2022 Digital Asset Outlook report, the aggregate supply of stablecoins has increased from $29 billion at the start of 2021 to more than $140 billion. That growth benefited a swathe of stablecoins, including tether (USDT) and USD coin (USDC), which is managed by a consortium that includes Circle and Coinbase.

Read more: 👉 theblockcrypto

'elEconomista' opens the first correspondent of a media outlet in Metaverso

An abundance of informative material of increasing relevance is already beginning to be generated

The current situation of the Metaverse will be analyzed the same as that of any other major sector of activity

The journalist Antonio Lorenzo will combine technological information with the new correspondent

Read more: 👉 eleconomista

Michael Jordan and Son Reveal First Tech Venture, Heir Platform to Feature NFTs and Leverage Solana

The legendary former professional basketball player Michael Jordan and his son Jeffrey Jordan have revealed they are getting into blockchain and Web 3.0 technology, according to an announcement published on December 15. The father and son duo’s first tech venture is called Heir Inc., a platform that aims to connect loyal fans with popular athletes. Furthermore, Jordan’s tech platform aims to launch a token called “heir” built on the Solana blockchain.

Jordan Duo to Launch Heir Platform in 2022, Heir Token to be Built on Solana

Michael Jordan and his son Jeffrey Jordan have announced their first tech product called Heir and the startup recently closed the company’s first $10 million seed round led by Thrive Capital. Furthermore, the seed financing investments for Heir Inc. stemmed from Solana Ventures, Chicago Bulls guard Lonzo Ball, William Wesley the executive vice president and senior basketball adviser for the New York Knicks, and the tech entrepreneur Alexis Ohanian.

Read more: 👉news.bitcoin

Nifty News: Ulbricht’s NFT bids top 261 ETH, Irishman producer funds movies with NFTs

Polygon has ramped up its NFT gaming plans with GameOn partnership, Irishman producer launches NFT firm to fund movies, and the Silk Road founder‘s NFT drop has fetched bids higher than $1 million.

Read more: 👉cointelegraph

Beast Legends Announces the Launch of a New Game-fi Game

NEW YORK, Dec. 20, 2021 (GLOBE NEWSWIRE) -- Beast Legends has launched a unique GameFi game, this game will bring players a new experience. GameFi integrates DeFi, NFT, and gaming, ensuring that the blockchain is no longer limited to digital assets. According to DappRadar, the number of chain game transactions reached $480.7 billion in the first half of 2021. As of mid-November 2021, there were more than 3 million chain gamers worldwide. When it comes to GameFi, you have to mention the hottest head GameFi games like Axie Infinity, Decentraland, and Sandbox. Although these game projects have achieved great success, the global GameFi market is currently mixed with good and bad. But there are also many up-and-coming projects that deserve attention. Beast Legends is a very promising GameFi game.

Read more: 👉globenewswire

We love to collect all opinions and points of view. Do you want to collaborate with us? Write to us at subscribers@betoken.capital.

Do you want to know us more?

Disclosure:

Authors may own funds mentioned in this newsletter. For more information, visit beToken.

beToken my Friend, beToken's newsletter, is intended for informational purposes only. It is not intended to serve as investment advice. Consult with your investment, tax or legal advisor before making any investment decision.

Advertising and sponsorship do not influence editorial decisions or content. Third-party advertisements and links to other sites where products or services are advertised are not endorsements or recommendations by beToken.

beToken is not responsible for the content of the advertisements, the promises made or the quality or reliability of the products or services offered in any third party advertisement.

If you liked this content on beToken my Friend, why don't you share it?